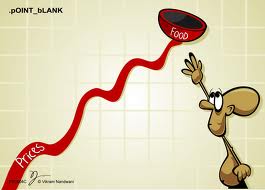

Food inflation plunges to 4-year low of 1.81%

This is the lowest rate of food inflation since the week ended February 9, 2008, when it stood at 2.26 per cent. Vegetables became cheaper by 26.37 per cent in the week ended Dec 10.

Food inflation fell sharply to a near four-year low of 1.81 per cent for the week ended December 10 as prices of essential items like vegetables, onion, potato and wheat declined.

This is the lowest rate of food inflation since the week ended February 9, 2008, when it stood at 2.26 per cent.

Food inflation, as measured by Wholesale Price Index (WPI), was 4.35 per cent in the previous week. It had stood at 13.22 per cent in the corresponding week of 2010.

According to the official data released today, onion became cheaper by 49.38 per cent year-on-year during the week under review, while potato prices were down by 34.39 per cent. Prices of wheat also fell by 4.21 per cent. Overall, vegetables became cheaper by 26.37 per cent.

The drastic fall in food inflation could be attributed to the high base effect. Food inflation has been in double digits for most part of this year. Good harvest and seasonality have also contributed to the decline. Food prices normally move down in the winter season.

"Food inflation also determines the overall inflation which the RBI uses for its policy direction. This shows the RBI is moving in the right direction," Madan Sabnavis, Chief Economists at CARE Ratings said.

The RBI has hiked key rates 13 times since March 2010 to rein in headline inflation, which continues to be over 9 per cent. However, in its latest review, the central bank had put brakes on the rate hike cycle, citing a slowdown in growth.

However, other food products grew more expensive on an annual basis, led by protein-based items.

Pulses became 14.22 per cent costlier during the week under review, while milk grew dearer by 11.19 per cent and eggs, meat and fish by 9.25 per cent.

Fruits also became 8.89 per cent more expensive on an annual basis, while cereal prices were up by 1.68 per cent.

Inflation in the overall primary articles category stood at 3.78 per cent during the week ended December 10, as against 5.48 per cent in the previous week. Primary articles have over 20 per cent weight in the wholesale price index. Fuel group inflation for week ended December 10 remained unchanged at 15.24 per cent (week-on-week).

AFFECT OF FOOD INFLATIONS :-

Banks in demand as food inflation slumps

Ten bank shares rose by 1.04% to 3.46% at 15:17 IST on BSE as food inflation declined sharply.

Punjab National Bank (up 3.46%), ICICI Bank (up 3.27%), Bank of India (up 3.24%), State Bank of India (up 2.93%), Yes Bank (up 2.78%), IndusInd Bank (up 2.37%), Axis Bank (up 2.31%), IDBI Bank (up 1.94%), HDFC Bank (up 1.49%) and Bank of Baroda (up 1.04%), edged higher.

The BSE Bankex was up 2.50% at 9,651.97. It outperformed the Sensex, which was up 0.86% at 15,819.89.

The food inflation eased sharply to 1.81% in the year to 10 December 2011, from an annual 4.35% rise in the previous week, government data showed on Thursday, 22 December 2011. The fuel inflation remained unchanged at 15.24% in the latest week compared with the prior week, data showed, while the primary articles price index rose 3.78%, compared with an annual rise of 5.48% in the previous week.

Meanwhile, banking shares also got a boost from Reserve Bank of India's (RBI) move to ease the liquidity crunch in the banking system. The central bank on Wednesday, 21 December 2011, relaxed some restrictions on borrowing by banks from it, in another move aimed at easing the cash crunch in the banking system. The RBI has allowed banks to avail themselves of funds from RBI on overnight basis, under Marginal Standing Facility (MSF), against their excess SLR holdings.

Additionally, banks can also avail themselves of funds, on overnight basis below the stipulated SLR, up to one per cent of their respective Net Demand and Time Liabilities outstanding at the end of second preceding fortnight. In the event the banks' SLR holdings fall below the statutory requirement, banks will not have the obligation to seek a specific waiver for default in SLR compliance arising out of use of this facility in terms of notification issued under sub section (2A) of Section 24 of the Banking Regulation Act, 1949, RBI said in a circular.

At its mid-quarterly monetary policy review meet on Friday, 16 December 2011, the RBI left its main lending rate unchanged in order to support faltering economic growth as inflation shows signs of cooling. While inflation remains on its projected trajectory, downside risks to growth have clearly increased, RBI said in a statement. From this point on, monetary policy actions are likely to reverse the cycle, responding to the risks to growth, RBI said.

However, it must be emphasised that inflation risks remain high and inflation could quickly recur as a result of both supply and demand forces, the central bank said in statement. Also, the rupee remains under stress, RBI said. The timing and magnitude of further actions will depend on a continuing assessment of how these factors shape up in the months ahead, RBI said. The RBI has raised rates 13 times since March 2010.

No comments:

Post a Comment